Latest scams and security alerts

We want to keep you up to date with all the latest

common security alerts. The faster you can recognise a scam, the better you

can dodge it.

To access an easy read format of information on how to avoid scams click here.

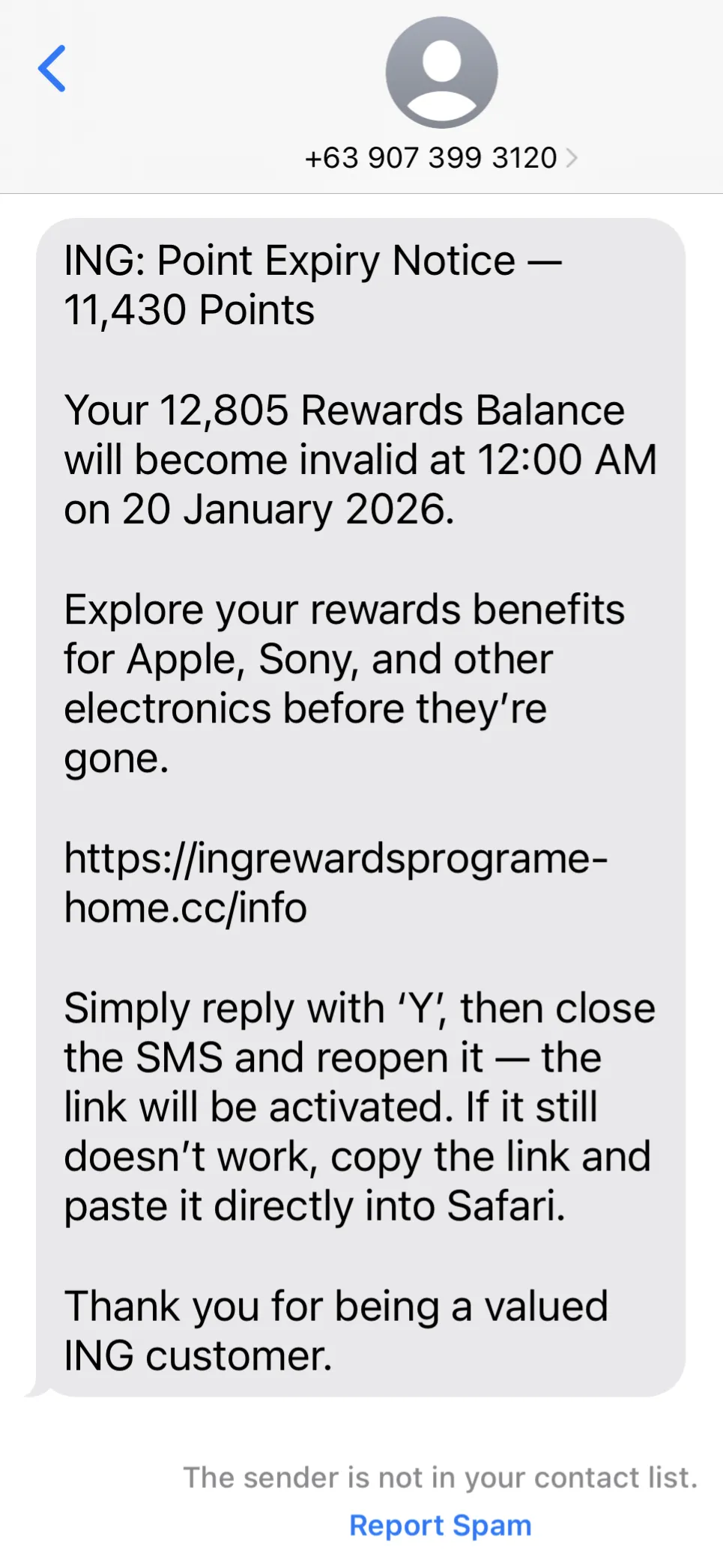

We're aware of fake SMS' currently circulating which claim to be from ING. These SMS' claim to be Point Expiry Notices for ING’s Pocket Perks and advising customers to access a link which will direct customers to a malicious website. Once you click on the link or open the attachment, you may be asked to enter your personal information such as such as card numbers, your banking customer number, banking passwords and security codes. Malware could also be installed on your device, or you might receive a call where scammers attempt to convince you to share personal or banking details with them.

While ING has taken steps to have these malicious websites taken down, there may be additional websites created to replace those that have been removed.

Some indicators that these SMS messages are not genuine include:

- SMS sent from an overseas phone number, eg. +63 907 399 3120

- Complicated web address structure, eg. https://ingrewardsprogramehome.cc/info

Be mindful of the following to help reduce your risk of being scammed:

- Never click on links to log in your Internet banking, always use the ING app or the secured log in page

- Check for spelling mistakes in the SMS, or the information doesn't make sense

- Always be wary of unsolicited messages from unknown numbers or numbers posing as a known company or business

- ING will never send you an SMS asking you to urgently complete an action through a link.

- Contact ING via a trusted number to verify if the message is genuine, do not use the number in the suspect SMS

Stay up to date with current scams targeting Australians via the ASIC Scamwatch website at www.scamwatch.gov.au

If you have any concerns relating to a suspected scams, call us on 1800 052 743.

Stay up to date: www.scamwatch.gov.au | More tips oaic.gov.au | Been scammed? Call 1800 052 743