Important Information

Establishment fees, Late payment fees and Interim statement fees apply.

Comparison rate

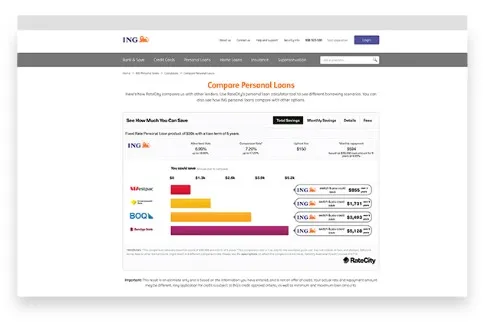

The comparison rate for the ING Personal Loan is based on an unsecured loan of $30,000 over a loan term of 5 years. WARNING: This comparison rate applies only to the example or examples given. Different amounts and terms will result in different comparison rates. Costs such as redraw fees or early repayment fees, and cost savings such as fee waivers, are not included in the comparison rate but may influence the cost of the loan.

The personalised interest rate is not an offer of credit and is based on your Equifax Australia Information Services and Solutions Pty Limited credit score. If the information you provide us to obtain your Equifax Australia Information Services and Solutions Pty Limited credit score is not accurate, the personalised interest rate may not apply. If you wish to apply for a personal loan please complete the application on the ING website. All applications for credit are subject to ING's eligibility and credit approval criteria.

getcreditscore.com.au is a service provided independently by a third party and is not connected to ING. ING does not endorse or accept any responsibility for this service, including any advice, communication, direct marketing contact or material prepared by them.

Information and interest rates are current as at the date of publication and are subject to change. All applications for credit are subject to ING's eligibility and credit approval criteria. Fees and charges apply. Redraw not available. Any advice in this message does not take into account your objectives, financial situation or needs and you should consider whether it is appropriate for you. Before making any decision in relation to an ING Personal Loan or Orange Everyday, you should read the Personal Loan Terms and Conditions and ING's Credit Guide, and the Orange Everyday Terms and Conditions and the Orange Everyday Fees & Limits Schedule, available at ing.com.au. To view these documents you may need Adobe Acrobat. If you have a complaint, please call us on 133 464 as we have procedures in place to help resolve any issues you may have. Products are issued by ING, a business name of ING Bank (Australia) Limited ABN 24 000 893 292, AFSL and Australian Credit Licence 229823.