Revolutionising the way you bank

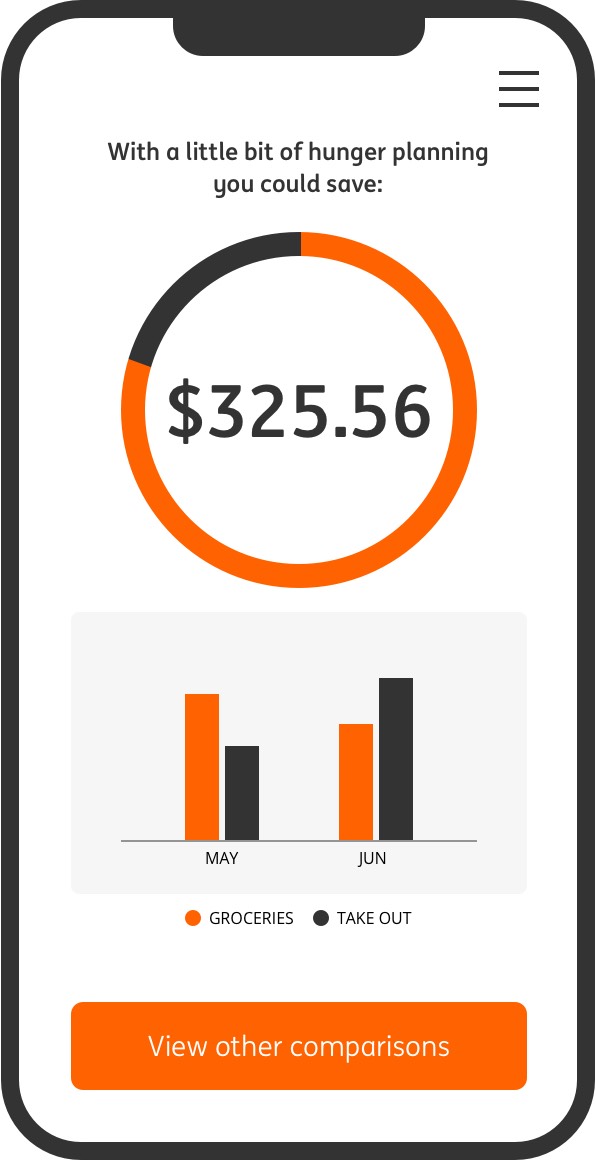

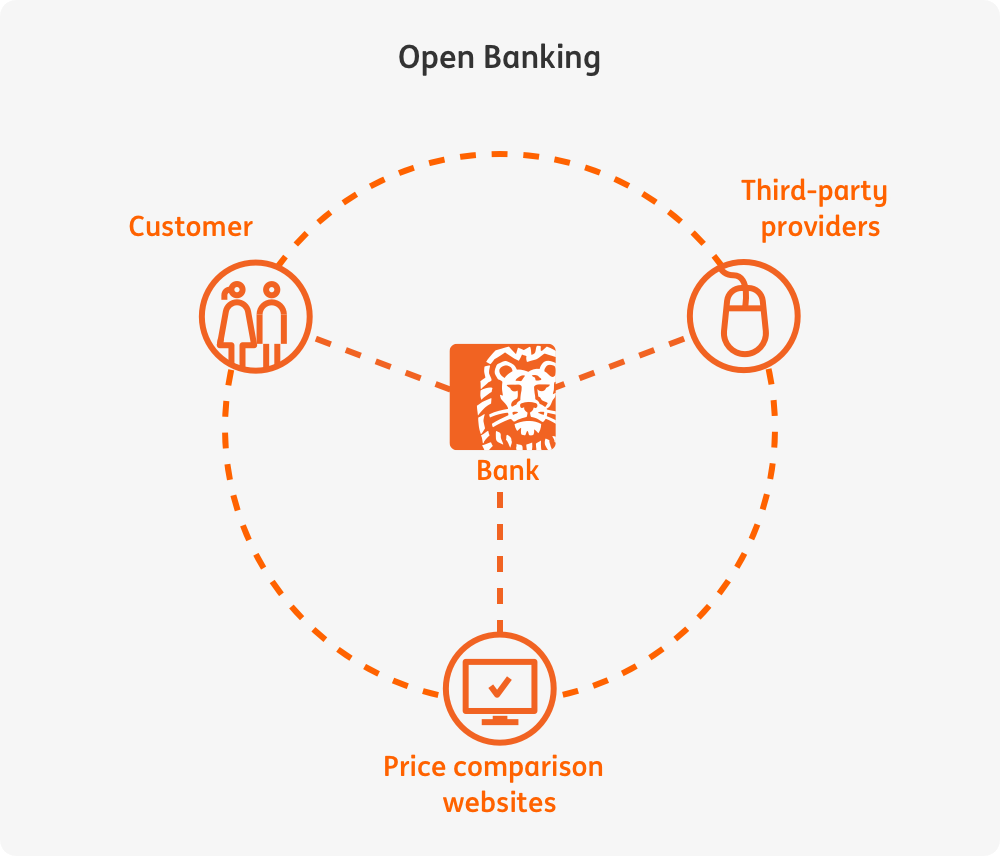

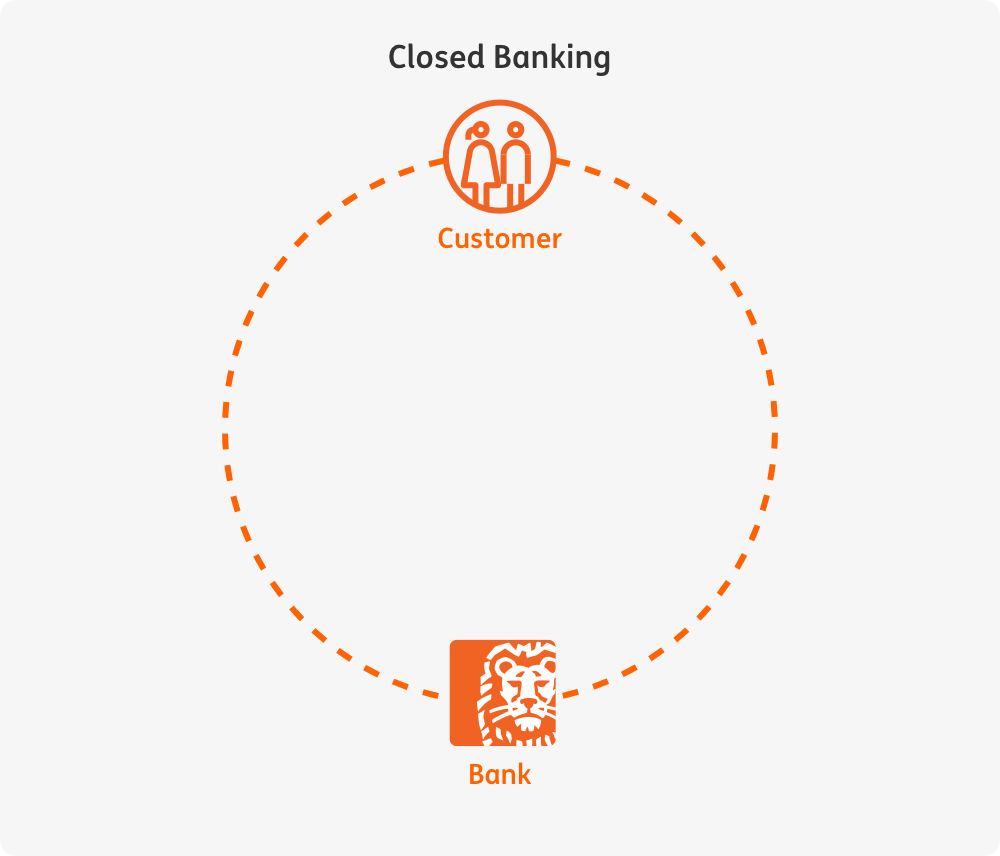

Open Banking is an exciting new chapter in Australian banking, giving you more control over your financial data. It is a key part of Australia’s Consumer Data Right (CDR, for short) that lets you securely share your banking data with accredited third parties (accredited data recipients) for tailored financial services and insights.

Ultimately, Open Banking aims to boost competition and enable smarter financial services that gives you better bang for your buck by giving you more power to negotiate on things like price and rates.

Being a digital bank, we’re naturally committed to championing Open Banking at ING.

The CDR has been expanded into the Energy sector and Non-bank lending is coming soon.