Why choose ING Health Insurance?

-

Cover options to suit your lifestyle

Whether it's just for the basics or cover for the whole family, we've got options. Plus enjoy an ongoing 4% discount for direct debit payments.

-

Gold member treatment

Find out how you can get Gold-level Hospital benefits if you have an accident with our Accidental Injury Benefit.

-

No surprises on Extras

Go to any provider with recognised professional qualifications for Extras like dental and physio. Plus get 60 - 75% back depending on your level of cover.

-

Easy switching

Switching from another provider is simple and easy. We'll get the transfer paperwork started for you. And you don't need to

re-serve waiting periods you've already served for the same level of cover. -

Emergency ambulance

For great peace of mind in case of accidents, all covers includes unlimited emergency ambulance (excluding those covered by state ambulance schemes).

-

Claims made simple

Claim online anytime it suits. If you can't claim on the spot, simply upload a picture of your receipt and we'll do the rest. Check on your activity and limits with a few clicks.

See our Policy Booklet for general terms of ING Health Insurance cover and our product Fact Sheets for specific cover details, waiting periods and exclusions. Check ING's Customer Eligibility and Name Screening document to understand ING's regulatory obligations and how we use your information to comply.

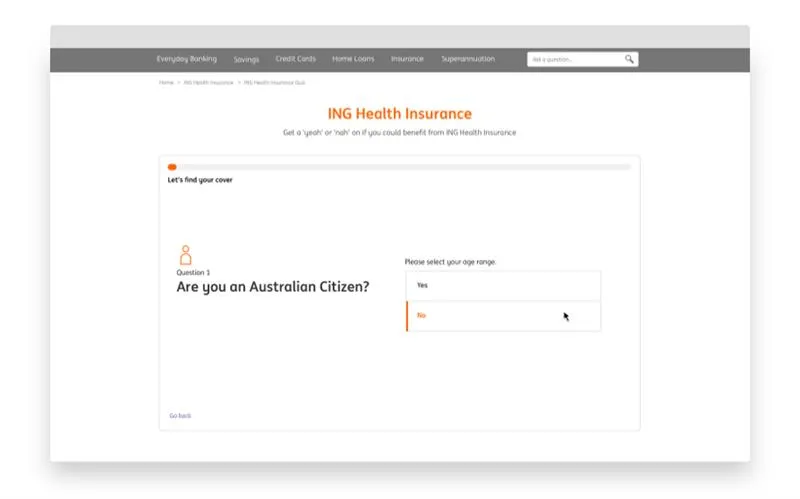

Important informationSelect your cover options and get a quote in less than 2 minutes

Rather talk? Call 1800 111 831. For operating hours, contact us here.