Overview

The Trustee has selected Mercer Investment (Australia) Limited as the new Investment Manager for Living Super. By appointing Mercer, the Fund gains access to global scale and the ability to improve the diversification and access to active management at similar fees to what members experience today. Over the long term, it aims to increase investment returns to members.

The following table summarises how each of the current Living Super managed investment options will be mapped when your account is transferred to OneSuper.

|

|

If you are currently invested in…

|

From 1 December 2023, you will be invested in…

|

|

Managed Investment Option

|

Balanced

|

Growth

|

|

Growth

|

Growth

|

|

High Growth

|

High Growth

|

|

Conservative

|

Conservative

|

|

Moderate

|

Moderate

|

|

Australian Fixed Interest

|

Australian Fixed Interest

|

|

Australian Listed Property

|

Australian Listed Property

|

|

Australian Shares

|

Australian Shares

|

|

International Fixed Interest (Hedged)

|

International Fixed Interest (Hedged)

|

|

International Shares

|

International Shares

|

|

International Shares (Hedged)

|

International Shares

|

|

Cash Option

|

Cash Option

|

|

N/A

|

Diversified Shares (new managed investment option)

|

There are two managed investment options that are not being transferred to OneSuper:

1. Balanced Option - If you are invested in the Living Super Balanced Option on 17 November 2023, you will be automatically transferred into the Growth Option within OneSuper.

2. International Shares (Hedged) Option - If you are invested in the Living Super International Shares (Hedged) Option on 17 November 2023, you will be automatically transferred into the International Shares Option within OneSuper.

For further information on the specifics of each managed investment option that will be available within OneSuper, including objectives, asset allocations, costs and risk profiles, please see the section below. You should ensure you are comfortable with the risks associated with your chosen investments.

Please note that as the Trustee is moving assets and changing the underlying investments, transaction costs may be incurred in the short-term and these will be reflected in the unit price of the relevant managed investment option.

Investment options that are changing

|

|

If you have money invested in this option...

|

You will be invested in this option after 1 December 2023

|

|

|

Cash Option

|

Cash Option

|

|

Who might invest in this option?

|

Conservative or cautious investors seeking security of capital and positive income returns over time.

|

Members who prefer very low risk and a high level of security on their account balance.

|

|

Investment objective

|

Aims to achieve a return of the benchmark.

Benchmark: RBA Cash Rate before fees and taxes.

|

Aims to achieve a return of the benchmark.

Benchmark: RBA Cash Rate before fees and taxes.

|

|

Growth/Defensive Allocation

|

0%/100%

|

0%/100%

|

|

Strategic Asset Allocation

|

Cash 100%

|

Cash 100%

|

|

Minimum suggested timeframe

|

There is no minimum suggested investment timeframe for this investment.

|

There is no minimum suggested investment timeframe for this investment.

|

|

Standard Risk Measure

|

SRM 1 - Very Low Risk

|

SRM 1 – Very Low Risk

|

|

Estimated number of negative returns over any 20-year period

|

Less than 0.5 in 20 years

|

Less than 0.5 in 20 years

|

|

Total Investment fees and costs % p.a. (including Transaction Costs)

|

0.00%

|

0.00% p.a.

|

|

Transaction Costs*

|

0.00%

|

0.00%

|

|

Buy-Sell spread

|

0.00%-0.00%

|

0.00%-0.00%

|

|

Cost of product for 1 year based on a $50,000 account balance

|

$60.00

|

$160.00

|

|

|

If you have money invested in this option...

|

You will be invested in this option after 1 December 2023

|

|

|

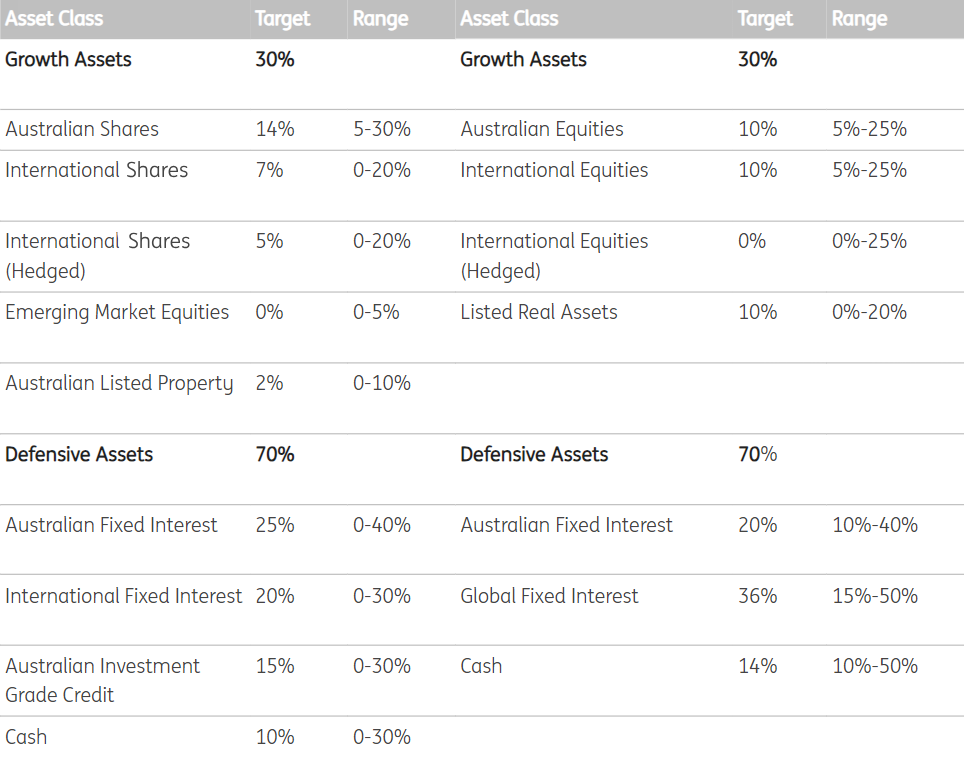

Conservative Option

|

Conservative Option

|

|

Who might invest in this option?

|

Investors who are seeking a higher return than available from Cash and who are prepared to accept a moderate exposure to growth assets.

|

Members who seek exposure to mainly defensive assets and can tolerate a moderate level of risk over the medium term. This option invests predominantly in defensive assets across most asset classes.

|

|

Investment objective

|

Aims to provide medium to long-term capital growth with income built into the unit price. Benchmark: 0.75% average annual return above inflation (CPI) over rolling 4 years after investment fees and costs, and taxes.

|

Aims to provide a net return after tax and investment costs equal to or better than inflation plus 0.75% p.a. when measured over any 4-year period.

|

|

Growth/Defensive Allocation

|

30%/70%

|

30%/70%

|

|

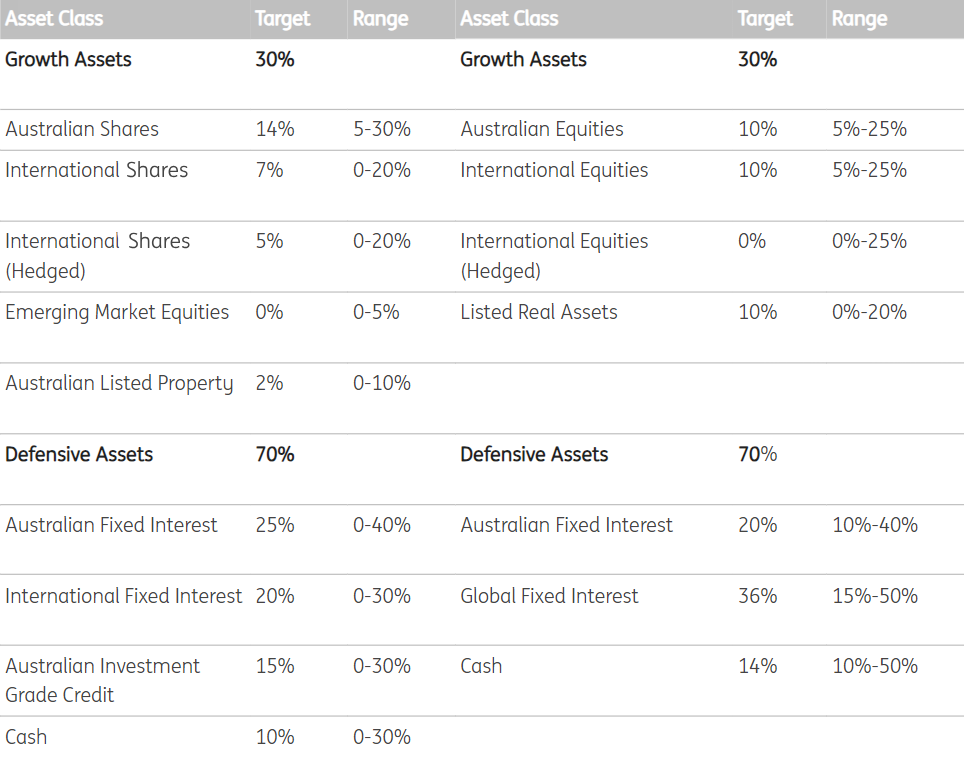

Strategic Asset Allocation

|

|

|

Minimum suggested timeframe

|

4 years

|

4 years

|

|

Standard Risk Measure

|

SRM 6 - High Risk

|

SRM 4 – Medium Risk

|

|

Estimated number of negative returns over any 20-year period

|

4 to less than 6 in 20 years

|

2 to less than 3 in 20 years

|

|

Total Investment fees and costs % p.a.

|

0.25%

|

0.31%

|

|

Transaction Costs*

|

0.02%

|

0.00%

|

|

Buy-Sell spread

|

0.05%-0.04

|

0.082% - 0.071%

|

|

Cost of product for 1 year based on a $50,000 account balance

|

$445.00

|

$390.00

|

|

|

If you have money invested in this option...

|

You will be invested in this option after 1 December 2023

|

|

|

Moderate Option

|

Moderate Option

|

|

Who might invest in this option?

|

Investors who are seeking a higher return than available from Cash and who are prepared to accept a moderate exposure to growth assets.

|

Members who seek exposure to a combination of growth and defensive assets and can tolerate a medium to high level of risk over the long term. This option invests predominantly in a mixture of growth and defensive assets across most asset classes.

|

|

Investment objective

|

Aims to provide medium to long-term capital growth with income built into the unit price. 1.5% average annual return above inflation (CPI) over rolling 6 years after investment fees and costs, and taxes.

|

Aims to provide a net return after tax and investment costs equal to or better than inflation plus 1.50% p.a. when measured over any 6-year period.

|

|

Growth/Defensive Allocation

|

50%/50%

|

50%/50%

|

|

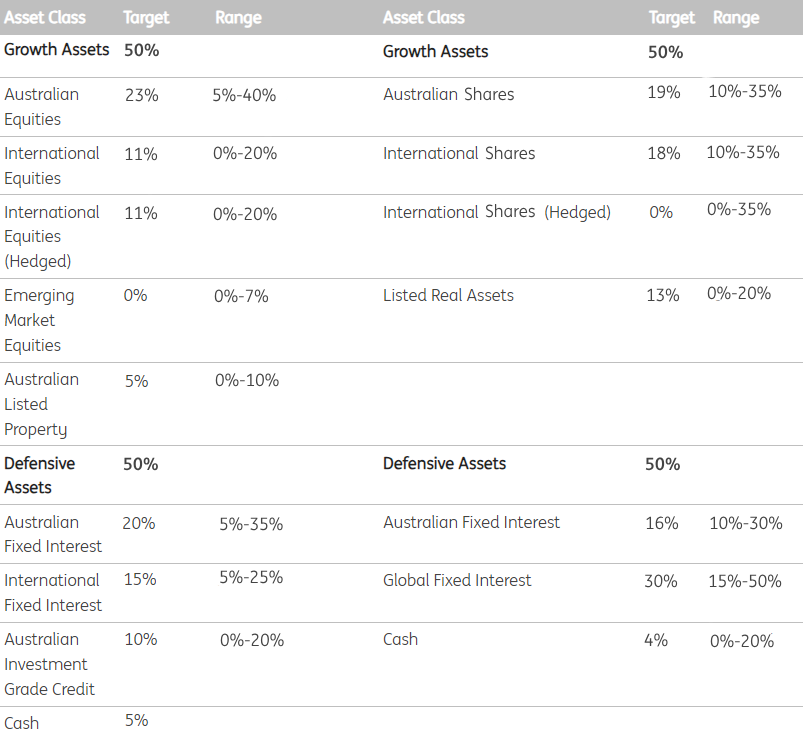

Strategic Asset Allocation

|

|

|

Minimum suggested timeframe

|

6 years

|

6 years

|

|

Standard Risk Measure

|

SRM 6 - High Risk

|

SRM 5 – Medium to High Risk

|

|

Estimated number of negative returns over any 20-year period

|

4 to less than 6 in 20 years

|

3 to less than 4 in 20 years

|

|

Total Investment fees and costs % p.a.

|

0.25%

|

0.31%

|

|

Transaction Costs*

|

0.02%

|

0.00%

|

|

Buy-Sell spread

|

0.06%-0.05%

|

0.097% - 0.088%

|

|

Cost of product for 1 year based on a $50,000 account balance

|

$445.00

|

$390.00

|

|

|

If you have money invested in this option...

|

You will be invested in this option after 1 December 2023

|

|

|

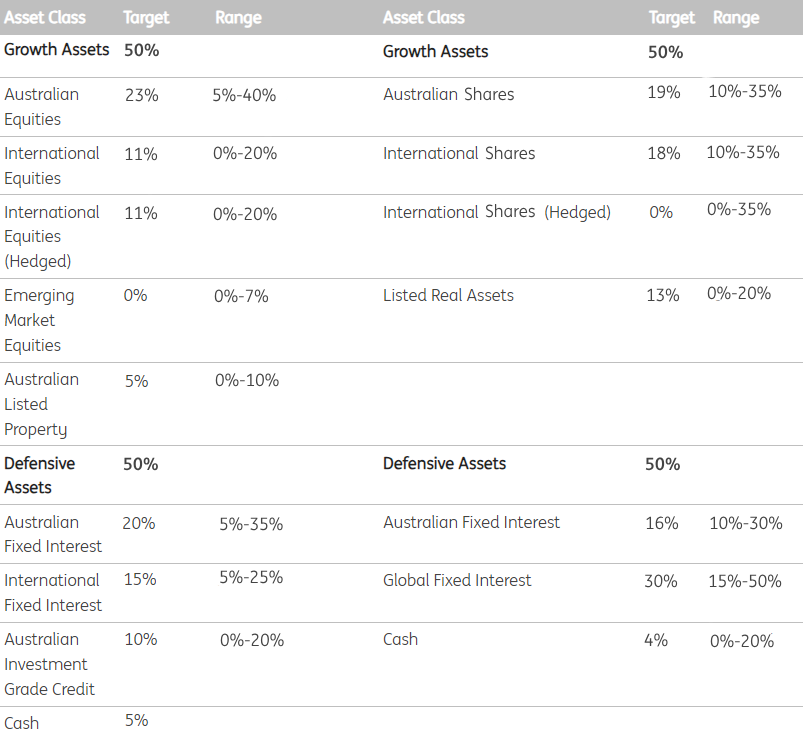

Growth Option

|

Growth Option

|

|

Who might invest in this option?

|

Investors who are seeking a long-term investment with high returns and who accept the possibility of losses in capital.

|

Members who seek exposure to mainly growth assets and can tolerate a high level of risk over the long term. This option invests mainly in growth assets across most asset classes.

|

|

Investment objective

|

Aims to provide long-term capital growth with income built into the unit price.

Benchmark: 2.25% average annual return above inflation (CPI) over rolling 8 years after investment fees and costs, and taxes.

|

Aims to provide a net return after tax and investment costs equal to or better than inflation plus 2.25% p.a. when measured over any 8-year period.

|

|

Growth/Defensive Allocation

|

70%/30%

|

75%/25

|

|

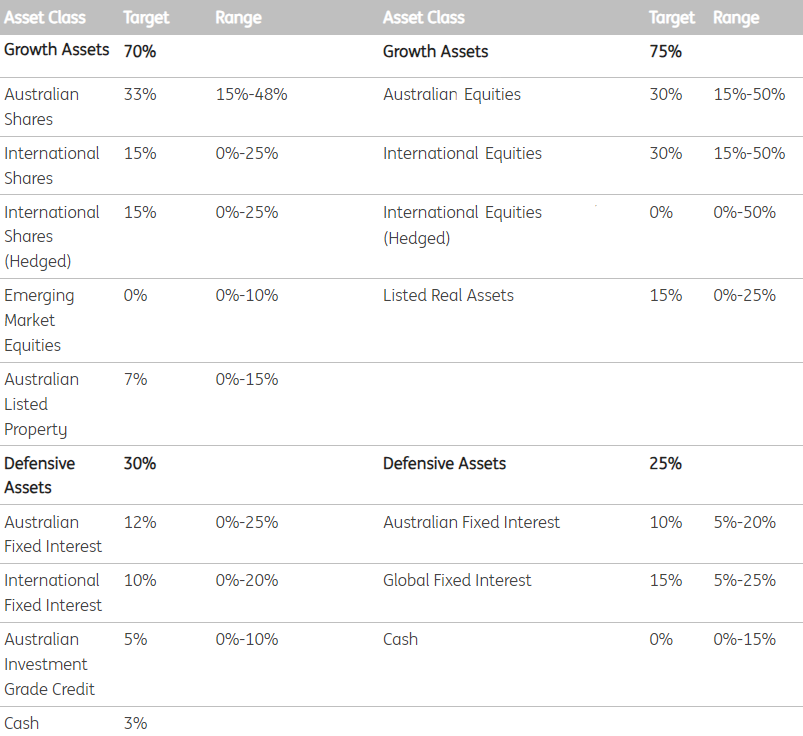

Strategic Asset Allocation

|

|

|

Minimum suggested timeframe

|

8 years

|

8 years

|

|

Standard Risk Measure

|

SRM 7 -Very High Risk

|

SRM 6 –High Risk

|

|

Estimated number of negative returns over any 20-year period

|

6 or greater in 20 years

|

4 to less than 6 in 20 years

|

|

Total Investment fees and costs % p.a.

|

0.25%

|

0.31%

|

|

Transaction Costs*

|

0.01%

|

0.00%

|

|

Buy-Sell spread

|

0.06%-0.05%

|

0.102% - 0.102%

|

|

Cost of product for 1 year based on a $50,000 account balance

|

$440.00

|

$390.00

|

|

|

If you have money invested in this option...

|

You will be invested in this option after 1 December 2023

|

|

|

Balanced Option

|

Growth Option

|

|

Who might invest in this option?

|

Investors who are seeking a higher return than available from cash and whom are prepared to accept a moderate exposure to growth assets

|

Members who seek exposure to mainly growth assets and can tolerate a high level of risk over the long term. This option invests mainly in growth assets across most asset classes.

|

|

Investment objective

|

Aims to provide medium to long-term capital growth with income built into the unit price. Benchmark 2.0% average return above inflation (CPI) over rolling 6 years after investment fees and taxes

|

Aims to provide a net return after tax and investment costs equal to or better than inflation plus 2.25% p.a. when measured over any 8-year period.

|

|

Growth/Defensive Allocation

|

62%/38%

|

75%/25%

|

|

Strategic Asset Allocation

|

Asset Class

|

Target

|

Range

|

Asset Class

|

Target

|

Range

|

|

Growth Assets

|

62%

|

|

Growth Assets

|

75%

|

|

|

Australian Shares

|

30%

|

15%-45%

|

Australian Equities

|

30%

|

15%-50%

|

|

International Shares

|

13%

|

0%-23%

|

International Equities

|

30%

|

15%-50%

|

|

International Shares (Hedged)

|

13%

|

0%-23%

|

International Equities (Hedged)

|

0%

|

0%-50%

|

|

Emerging Market Equities

|

0%

|

0%-10%

|

Listed Real Assets

|

15%

|

0%-25%

|

|

Australian Listed Property

|

6%

|

0%-10%

|

|

|

|

|

Defensive Assets

|

38%

|

|

Defensive Assets

|

25%

|

|

|

Australian Fixed Interest

|

16%

|

5%-30%

|

Australian Fixed Interest

|

10%

|

5%-20%

|

|

International Fixed Interest

|

11%

|

0%-20%

|

Global Fixed Interest

|

15%

|

5%-25%

|

|

Australian Investment Grade Credit

|

7%

|

0%-15%

|

Cash

|

0%

|

0%-15%

|

|

Cash

|

4%

|

0%-20%

|

|

|

|

|

Minimum suggested timeframe

|

6 years

|

8 years

|

|

Standard Risk Measure

|

SRM 6 - High Risk

|

SRM 6 –High Risk

|

|

Estimated number of negative returns over any 20-year period

|

4 to less than 6 in 20 years

|

4 to less than 6 in 20 years

|

|

Total Investment fees and costs % p.a.

|

0.25%

|

0.31%

|

|

Transaction Costs*

|

0.01%

|

0.00%

|

|

Buy-Sell spread

|

0.06%- 0.05%

|

0.102% - 0.102%

|

|

Cost of product for 1 year based on a $50,000 account balance

|

$440.00

|

$390.00

|

|

|

If you have money invested in this option...

|

You will be invested in this option after 1 December 2023

|

|

|

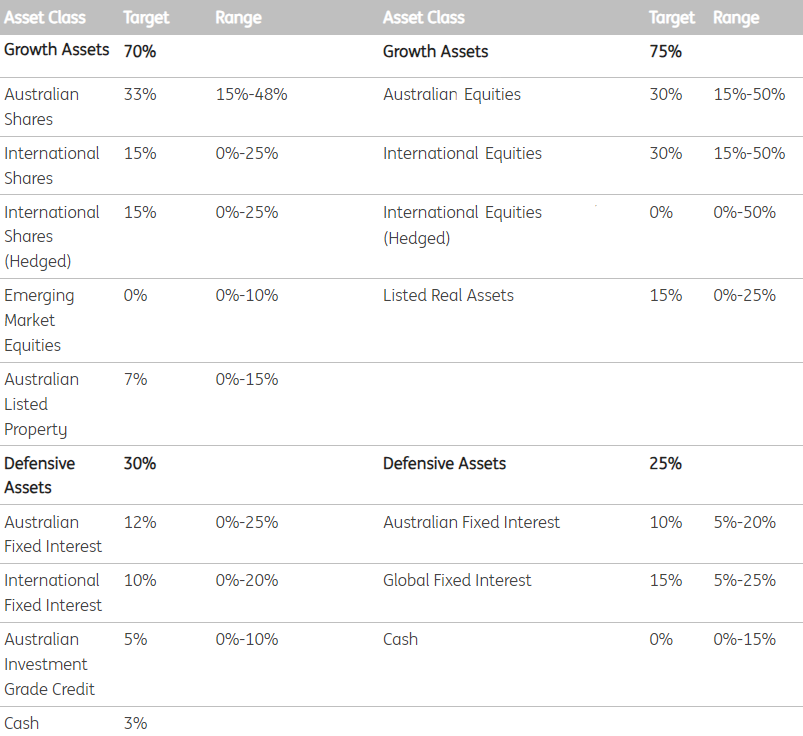

High Growth Option

|

High Growth Option

|

|

Who might invest in this option?

|

Investors who are seeking a long-term investment with moderate to high returns and who accept the possibility of losses in capital.

|

Members who seek exposure to mainly growth assets and can tolerate a high level of risk over the long term. This option invests mainly in growth assets across most asset classes.

|

|

Investment objective

|

Aims to provide long- term capital growth with income built into the unit price. Benchmark: 3.25% average annual return above inflation (CPI) over rolling 10 years after investment fees and costs, and taxes.

|

Aims to provide a net return after tax and investment costs equal to or better than inflation plus 3.25% p.a. when measured over any 10-year period.

|

|

Growth/Defensive Allocation

|

95%/5%

|

95%/5%

|

|

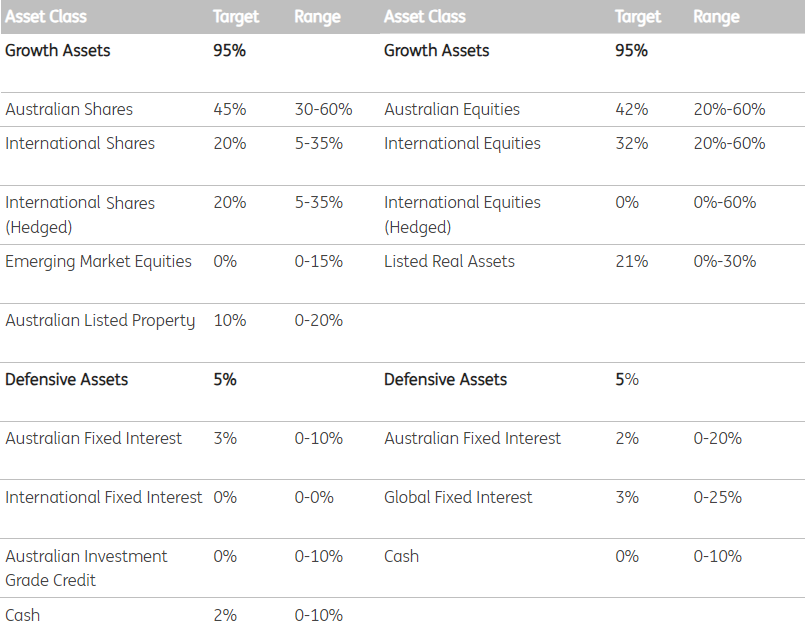

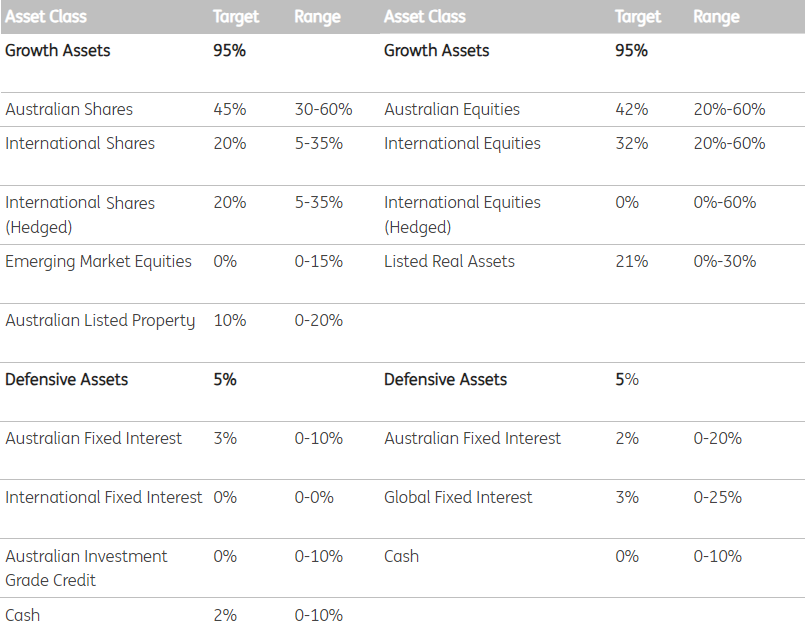

Strategic Asset Allocation

|

|

|

Minimum suggested timeframe

|

10 years

|

10 years

|

|

Standard Risk Measure

|

SRM 7 - Very High Risk

|

SRM 6 –High Risk

|

|

Estimated number of negative returns over any 20-year period

|

6 or greater in 20 years

|

4 to less than 6 in 20 years

|

|

Total Investment fees and costs % p.a.

|

0.25%

|

0.310%

|

|

Transaction Costs*

|

0.01%

|

0.00%

|

|

Buy-Sell spread

|

0.07%-0.06%

|

0.115% - 0.119%

|

|

Cost of product for 1 year based on a $50,000 account balance

|

$440.00

|

$390.00

|

|

|

If you have money invested in this option...

|

You will be invested in this option after 1 December 2023

|

|

|

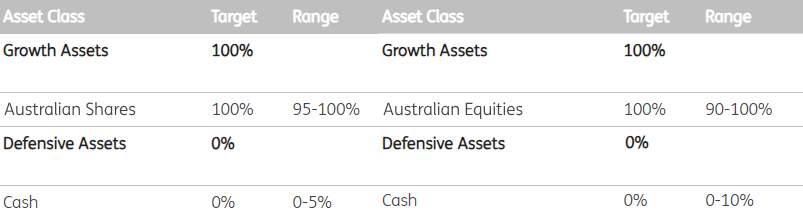

Australian Shares

|

Australian Shares

|

|

Who might invest in this option?

|

Investors who are seeking a long-term investment in a diversified portfolio of Australian securities and who accept the possibility of losses in capital.

|

Members who seek exposure to a broad range of companies listed on the Australian Stock Exchange across large and small capitalisation companies with a mix of index and active management.

|

|

Investment objective

|

Aims to closely match the return of the Australian share market benchmark, before fees and taxes. Benchmark: The S&P/ASX 200 Accumulation Index.

|

The Option aims to closely match the return of the underlying index (S&P/ASX 300 Accumulation Index) over rolling seven year periods after investment fees and costs, and taxes.

|

|

Growth/Defensive Allocation

|

100%/0%

|

100%/0%

|

|

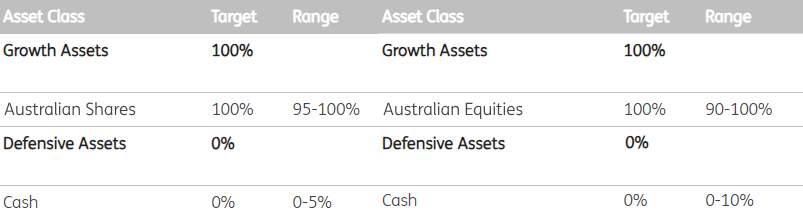

Strategic Asset Allocation

|

|

|

Minimum suggested timeframe

|

7 years.

|

7 years

|

|

Standard Risk Measure

|

SRM 7 – Very High Risk

|

SRM 6 –High Risk

|

|

Estimated number of negative returns over any 20-year period

|

6 or greater in 20 years

|

4 to less than 6 in 20 years

|

|

Total Investment fees and costs % p.a.

|

0.25%

|

0.290%

|

|

Transaction Costs*

|

0.00%

|

0.00%

|

|

Buy-Sell spread

|

0.05%-0.05%

|

0.11% - 0.11%

|

|

Cost of product for 1 year based on a $50,000 account balance

|

$435.00

|

$380.00

|

|

|

If you have money invested in this option...

|

You will be invested in this option after 1 December 2023

|

|

|

International Shares (Hedged)

|

International Shares

|

|

Who might invest in this option?

|

Investors who are seeking a long-term investment in a diversified portfolio of international securities that is protected against movements in currency exchange rates and who accept the possibility of losses in capital.

|

Members who seek exposure to companies listed on international exchanges across developed and emerging markets with a mix of index and active management.

|

|

Investment objective

|

Aims to closely match the return of the international securities market benchmark, before fees and taxes.

Benchmark: The MSCI World ex-Australia Index (net Dividends reinvested), hedged to Australian dollars.

|

The Option aims to closely match the return of the underlying index (MSCI World (ex-Aus) (UH) Index) over rolling seven year periods after investment fees and costs, and taxes.

|

|

Growth/Defensive Allocation

|

100%/0%

|

100%/0%

|

|

Strategic Asset Allocation

|

|

|

Minimum suggested timeframe

|

7 years

|

7 years

|

|

Standard Risk Measure

|

SRM 7 - Very High Risk

|

SRM 6 –High Risk

|

|

Estimated number of negative returns over any 20-year period

|

6 or greater in 20 years

|

4 to less than 6 in 20 years

|

|

Total Investment fees and costs % p.a.

|

0.25%

|

0.28%

|

|

Transaction Costs*

|

0.04%

|

0.00%

|

|

Buy-Sell spread

|

0.09%-0.06%

|

0.067% - 0.092%

|

|

Cost of product for 1 year based on a $50,000 account balance

|

$455.00

|

$375.00

|

|

|

If you have money invested in this option...

|

You will be invested in this option after 1 December 2023

|

|

|

International Shares

|

International Shares

|

|

Who might invest in this option?

|

Investors who are seeking a long-term investment in a diversified portfolio of international

securities who accept the possibility of losses in capital.

|

Members who seek exposure to companies listed on international exchanges across developed and emerging markets with a mix of index and active management.

|

|

Investment objective

|

Aims to closely match the return of the international securities market benchmark, before fees and taxes.

Benchmark: The MSCI World ex-Australia Index (net Dividends reinvested).

|

The Option aims to closely match the return of the underlying index (MSCI World (ex-Aus) (UH) Index) over rolling seven year periods after investment fees and costs, and taxes.

|

|

Growth/Defensive Allocation

|

100%/0%

|

100%/0%

|

|

Strategic Asset Allocation

|

|

|

Minimum suggested timeframe

|

8 years

|

7 years

|

|

Standard Risk Measure

|

SRM 6 –High Risk

|

SRM 6 –High Risk

|

|

Estimated number of negative returns over any 20-year period

|

4 to less than 6 in 20 years

|

4 to less than 6 in 20 years

|

|

Total Investment fees and costs % p.a.

|

0.25%

|

0.277%

|

|

Transaction Costs*

|

0.00%

|

0.00%

|

|

Buy-Sell spread

|

0.07%-0.04%

|

0.067% - 0.092%

|

|

Cost of product for 1 year based on a $50,000 account balance

|

$435.00

|

$375.00

|

|

|

If you have money invested in this option...

|

You will be invested in this option after 1 December 2023

|

|

|

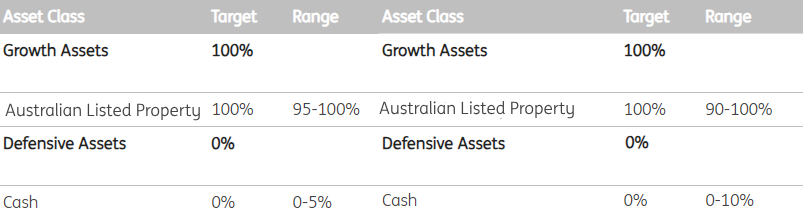

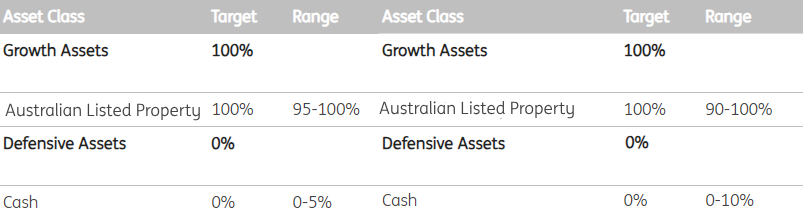

Australian Listed Property

|

Australian Listed Property

|

|

Who might invest in this option?

|

Investors who are seeking a long-term investment in a diversified portfolio of listed property

securities listed on the ASX and who accept the possibility of losses in capital.

|

Members who seek exposure to property related listed companies in Australia

|

|

Investment objective

|

Aims to closely match the return of the Australian listed property securities market benchmark, before fees and taxes. Benchmark: The S&P/ASX 200 A-REIT Index.

|

The Option aims to closely match the return of the underlying index (S&P/ASX200 Listed Property Index) over rolling seven year periods after investment fees and costs, and taxes .

|

|

Growth/Defensive Allocation

|

100%/0%

|

100%/0%

|

|

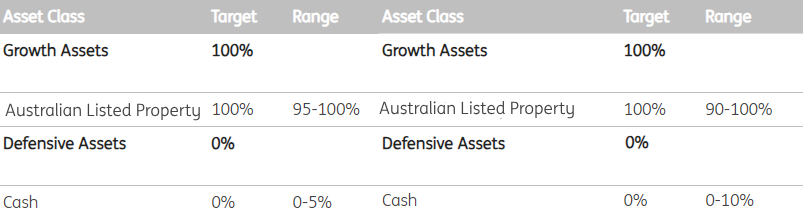

Strategic Asset Allocation

|

|

|

Minimum suggested timeframe

|

7 years

|

7 Years

|

|

Standard Risk Measure

|

SRM7 - Very High Risk

|

SRM6 –High Risk

|

|

Estimated number of negative returns over any 20-year period

|

6 or greater in 20 years

|

4 to less than 6 in 20 years

|

|

Total Investment fees and costs % p.a.

|

0.25%

|

0.26%

|

|

Transaction Costs*

|

0.00%

|

0.00%

|

|

Buy-Sell spread

|

0.08%-0.08%

|

0.16%-0.16%

|

|

Cost of product for 1 year based on a $50,000 account balance

|

$435.00

|

$385.00

|

|

|

If you have money invested in this option...

|

You will be invested in this option after 1 December 2023

|

|

|

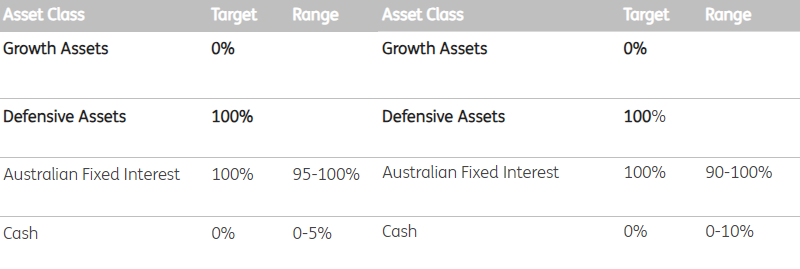

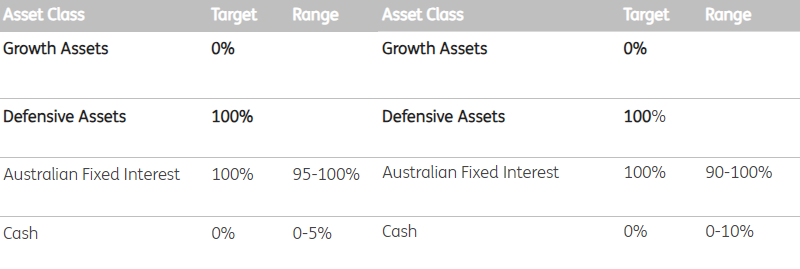

Australian Fixed Interest

|

Australian Fixed Interest

|

|

Who might invest in this option?

|

Members who seek exposure to primarily Australian fixed interest securities, generating

income with some capital growth potential over the long term. Capital losses may occur over the short term capital.

|

Members who seek exposure to primarily Australian fixed interest securities, generating income with some capital growth potential over the long term.

|

|

Investment objective

|

Aims to closely match the return of the Australian fixed interest market benchmark, before fees and taxes. Benchmark: The Bloomberg AusBond Composite Bond Index.

|

The Option aims to closely match the return of the underlying index (Bloomberg AusBond Treasury 0+Yr) over rolling seven year periods after investment fees and costs, and taxes .

|

|

Growth/Defensive Allocation

|

0%/100%

|

0%/100%

|

|

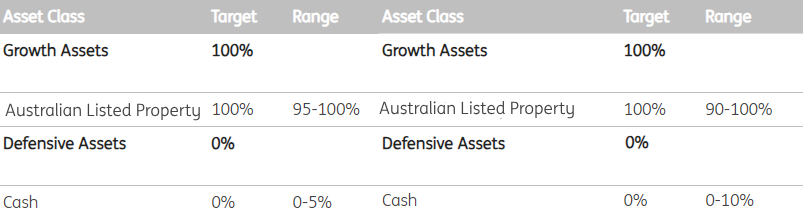

Strategic Asset Allocation

|

|

|

Minimum suggested timeframe

|

3 years

|

7 years

|

|

Standard Risk Measure

|

SRM5 - Medium to High Risk

|

SRM5 - Medium to High Risk

|

|

Estimated number of negative returns over any 20-year period

|

3 to less than 4 in 20 years

|

3 to less than 4 in 20 years

|

|

Total Investment fees and costs % p.a.

|

0.25%

|

0.26%

|

|

Transaction Costs*

|

0.00%

|

0.00%

|

|

Buy-Sell spread

|

0.04%-0.04%

|

0.02%-0.03%

|

|

Cost of product for 1 year based on a $50,000 account balance

|

$435.00

|

$365.00

|

|

|

If you have money invested in this option...

|

You will be invested in this option after 1 December 2023

|

|

|

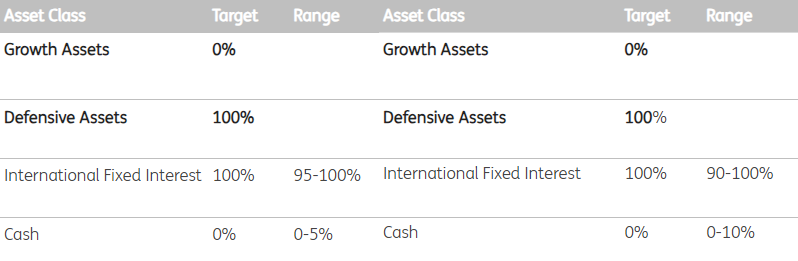

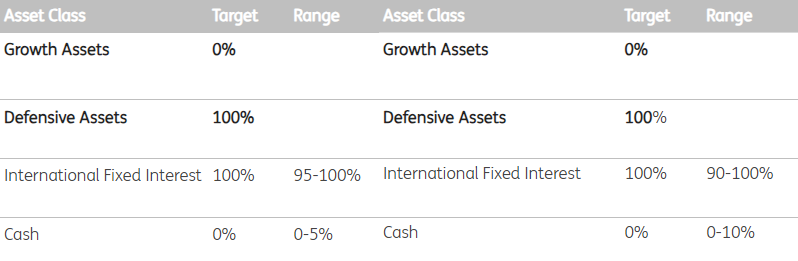

International Fixed Interest (Hedged)

|

International Fixed Interest (Hedged)

|

|

Who might invest in this option?

|

Investors who are seeking a return higher than Cash from international fixed interest and is protected against movements in currency exchange rates. Capital losses may occur over the short term

|

Members who seek exposure to primarily global fixed interest securities, generating income with some capital growth potential over the long term.

|

|

Investment objective

|

Aims to closely match the return of the international fixed interest market benchmark, before fees and taxes. Benchmark: The Citigroup World Government Bond ex- Australia Index, hedged to Australian dollars.

|

The Option aims to closely match the return of the underlying index (JP Morgan Global Sovereign Bond Index $A (Hedged)) over rolling seven year periods after investment fees and costs, and taxes.

|

|

Growth/Defensive Allocation

|

0%/100%

|

0%/100%0%/100%

|

|

Strategic Asset Allocation

|

|

|

Minimum suggested timeframe

|

3 years

|

7 Years

|

|

Standard Risk Measure

|

SRM5 - Medium to High Risk

|

SRM6 - High Risk

|

|

Estimated number of negative returns over any 20-year period

|

3 to less than 4 in 20 years

|

4 to less than 6 in 20 years

|

|

Total Investment fees and costs % p.a.

|

0.25%

|

0.31%

|

|

Transaction Costs*

|

0.04%

|

0.00%

|

|

Buy-Sell spread

|

0.06%-0.04%

|

0.06%-0.07%

|

|

Cost of product for 1 year based on a $50,000 account balance

|

$455.00

|

$390.00

|

|

|

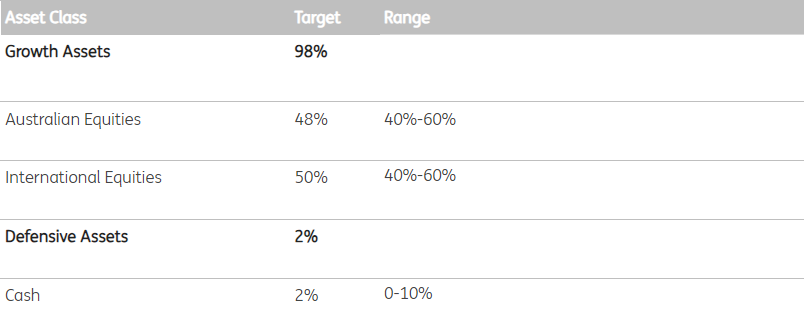

A new managed investment option is being added from 1 December 2023

|

|

|

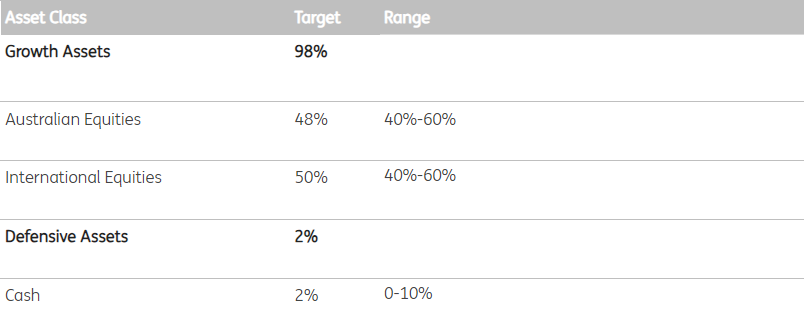

Diversified Shares

|

|

Who might invest in this option?

|

Members who seek exposure to Australian and international listed companies with a mix of index and active management.

|

|

Investment objective

|

Aims to provide a net return equal to or better than inflation plus 4.0% p.a. when measured over any 10-year period after investment fees and costs, and taxes.

|

|

Growth/Defensive Allocation

|

98%/2%

|

|

Strategic Asset Allocation

|

|

|

Minimum suggested timeframe

|

10 years

|

|

Standard Risk Measure

|

SRM6 - High Risk

|

|

Estimated number of negative returns over any 20-year period

|

4 to less than 6 in 20 years

|

|

Total Investment fees and costs % p.a.

|

0.30%

|

|

Transaction Costs*

|

0.00%

|

|

Buy-Sell spread

|

0.074%-0.085%

|

|

Cost of product for 1 year based on a $50,000 account balance

|

$380

|

|

*Transaction costs are an estimate only, based on the costs incurred in the previous financial year. Transaction costs payable may be higher or lower.

Cash Hub

Any investments held within the Cash Hub as at 5pm on 17 November 2023 will be transferred to a new Cash Hub that will be created for you within OneSuper.

Listed securities and term deposits

Any investments in listed securities (S&P/ASX 300 and approved ASX-listed exchange traded products) and term deposits will remain unchanged. The transfer value for each investment will depend on the asset price used at the time of transfer. Your investments will be transferred in-specie, which means that the investments will not be sold down to cash, your existing cost base history will be carried across and no CGT (capital gains tax) event will be triggered.

To facilitate the transfer, please note that any limit order trades still open at 5pm on 17 November 2023 will be cancelled. We will write to you separately if you have any limit order trades still open on 17 November 2023. Once the Limited Services Period is finished, from 18 December 2023 if you still wish for these limit orders to be in place, you will need to log into your account and request it again. In addition, the Trustee will not be participating in any corporate actions that require an action (i.e. opting in etc) during the Limited Services Period. As detailed in the Fund’s PDS, participation in any corporate action is entirely at the Trustee’s discretion.

All term deposits that mature during the Limited Services Period will be deposited into your Cash Hub. If you previously submitted an instruction to reinvest either your ‘principal amount’ or your ‘principal amount and interest’ into another term deposit with the same term, due to the Limited Services Period, these instructions will not be actioned and your matured term deposit will be credited into your Cash Hub. We will write to you separately if you have submitted a reinvestment instruction on a term deposit that is due to mature during the Limited Services Period. Once the Limited Services Period is finished, from 18 December 2023 if you wish to reinvest into a term deposit, you will need to log into your account and request a new term deposit.