-

Bank & Save

Everyday Banking

Personal Savings

-

All personal savings

Get ahead or stay that way with an ING savings account.

-

Savings Maximiser

High variable interest rate. With competitive ongoing rates, all your money goes towards your savings goals.

-

Personal Term Deposit

High interest rate guaranteed for the term. You choose the timeframe.

-

Savings Accelerator

Tiered savings account with higher variable interest rates for balances starting at $50,000.

Business Savings

-

All business savings

Straightforward banking for your business.

-

Business Optimiser

Variable interest business savings account with 24/7 access.

-

Business Term Deposit

Fixed interest rate for business savings. You choose the timeframe.

-

Wholesale Term Deposit

Competitive interest rates for a fixed period, that's tailored to your cash flow needs.

Your tools

Your tools

-

-

Credit Cards

-

Personal Loans

Personal Loans

-

All Personal Loans

Unsecured personal loan with a low fixed rate, no ongoing monthly fees and no early repayment fees.

-

Personal Loan for Car

Hit the road sooner

-

Personal Loan for Reno

Make your renovation dream a reality

-

Personal Loan for Wedding

Plan your perfect day

-

Personal Loan for Travel

Tick off your bucket list destinations

-

Personal Loan for Debt Consol

Show your bills who's boss

-

-

Home Loans

Home Loans

-

All home loans

Home loans for buyers, investors and borrowers looking for a better deal.

-

Mortgage Simplifier

Low variable interest rate home loan with no ongoing monthly or annual fees.

-

Orange Advantage

Includes a 100% interest offset when linked to our Orange Everyday bank account.

-

Fixed Rate Loan

Fixed interest rate home loans for terms of one to five years.

Commercial Loans

-

-

Insurance

Insurance

Car Insurance

-

ING Car Insurance

Save 15% on your first year's premium when you purchase a policy online. T&Cs apply - see disclaimer below.

-

ING Comprehensive Car Insurance

Covers loss or damage to your car plus the damage it causes to other people's vehicles and property for which you are liable.

-

ING Third Party Car Insurance

Covers your liability for $20 million worth of accidental damage your car causes to other people's vehicles and property.

Health Insurance

Home and Contents Insurance

Motorcycle Insurance

Pet Insurance

Travel Insurance

Your tools

15% off

ING Car InsuranceOn your first year's premium when you purchase a policy online.

T&Cs apply - see disclaimer below.

Your tools

Documents and forms8 weeks free with

ING Health InsuranceJoin now and get 8 weeks free when you take out a combined Hospital and Extras cover by 30 April 2024.

T&Cs apply. See full terms and conditions.

Your tools

Set up your online access30% off ING Home &

Contents InsuranceOn your first year's premium when you purchase a combined policy online. T&Cs apply - see disclaimer below.

Your tools

15% off ING

Motorcycle InsuranceOn your first year's premium when you purchase a policy online.

T&Cs apply - see disclaimer below.

Your tools

15% off

ING Pet InsuranceOn your first year's premium when you purchase a policy online.

T&Cs apply - see disclaimer below.

-

-

Superannuation

- About us

- Contact us

- Help and support

- Security info

- BSB: 923-100

Personal Loans

- Home

- ING Personal Loans

- ING Personal Loan for your home renovation

Fixed rate

From

6.89

% p.a.

To

18.99

% p.a.

Comparison Rate

From

7.10

% p.a.

To

19.23

% p.a.

- Loan amounts up to $60,000 for a healthy budget buffer

- Same day funds when you have an existing Orange Everyday account

- Peace of mind with a low personalised fixed interest rate

Get those paint rollers rolling sooner with an ING Personal Loan for your home renovation

Got home renovation plans you can't wait to get started on? Spare room looking more like a scare room? Whether you plan to DIY or outsource all of the trades, a fixed and unsecured personal loan from ING could be just what you needed. With loan amounts up to $60,000, no ongoing monthly or annual fees and no early payout fees - it's what the ING Personal Loan doesn't have that makes it special.

Personal Loan Features

It only takes about 20 minutes to complete our online application form.

Work out how much you might be able to borrow.

Tools and calculators

Calculators

See in to the future and know exactly what your personal loan repayments for your home improvements will be. This table lets you work out your repayments, borrowing power and just how much an ING Personal Loan can save you with a low personalised fixed interest rate.

Repayments

Loan amount (Min $5,000, Max $60,000)

ING offers personal loans between $5,000 and $60,000

Loan term (Min 2 years, Up to 7 years)

Oops, 6 and 7 year repayment terms are only available for loans over $30,000.

Loan term should be between 2 and years

Estimate your credit rating

Comparison rate:

Payment Frequency

Estimated repayments

$ 0

In the next step we will collect some personal details to check your credit score and give you your personalised rate. From here you can decide if you want to continue with your application.

Get my rate & applyMaximum Loan amount for Casual and Contractor Employees is $30,000

Borrowing power

Loading

About you

Dependents:

Postcode:

Your income

Gross monthly salary:

Other monthly income:

Your monthly expenses

Living expenses:

Rent / Mortgage repayments:

Total other loan repayments:

Total credit card limit:

Debt consolidation (if applicable)

Other loan limit

to consolidate:

Credit card limit

to consolidate:

Estimated borrowing power

$-

(rounded down to nearest $500)

Maximum Loan amount for Casual and Contractor Employees is $30,000

Sorry, we're unable to consider a loan application based on the details entered.

Estimated monthly repayments

$-

(based on estimated borrowing power)

Fixed interest rate: -% p.a.

Comparison rate: -% p.a. (Warning.)

Sorry, we're unable to consider a loan application based on the details entered.

Important: This result is an estimate only and is based on the information you have entered, and is not an offer of credit. Your actual rate and repayment amount may be different. Any application for credit is subject to ING's credit approval criteria, as well as minimum and maximum loan amounts.

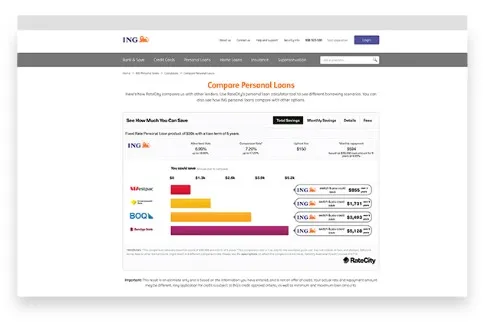

See what you could save

See what you could save when you transfer to an ING Personal Loan

Thinking about taking out a personal loan with ING? Use RateCity's personal loan calculator to see how much you'd have to repay under different borrowing scenarios. You can also see how ING personal loans compare with other options.

Rates, fees and limits

Rates, fees and limits

With an ING Personal Loan, we've made the ins and out super simple. No ongoing fees. No early repayment fees. No exit fees. Plus, a low personalised fixed interest rate.

Interest rates

-

Fixed interest ratefrom % p.a. to % p.a.

-

Comparison ratefrom % p.a. to % p.a.

Fees

-

Establishment fee$150

-

Monthly fee$0

-

Late payment fee$20

-

Early repayment fee$0

-

Interim statement fee$7 per statement

Limits

-

Minimum loan amount$5,000

-

Maximum loan amount$60,000.

Maximum Loan amount for Casual and Contractor Employees is $30,000. -

Available termsFor loan amounts up to and including $30,000: 2 to 5 years For loan amounts higher than $30,000: 2 to 7 years

Terms & conditions

All the detail to help you make an informed decision.

It only takes about 20 minutes to complete our online application form.

Work out how much you might be able to borrow.

Resources

Your personal loan resources kit

In planning mode? We've got some tips and calculators to help you.

Tips, hints and guides

Forms

Calculators

It only takes about 20 minutes to complete our online application form.

Work out how much you might be able to borrow.

FAQs

Got a question about the ING Personal Loan?

Chances are, you'll find the answer in our FAQs.

Here are some of the more common questions we get asked:

It only takes about 20 minutes to complete our online application form.

Work out how much you might be able to borrow.

How to apply

Ready for an ING Personal Loan?

If you want to borrow between $5,000 and $60,000, all you have to do is:

1. Apply

It only takes about 20 minutes to complete our online application form.

2. Accept the contract

While we work through your application, we'll keep you in the loop via email and SMS. If approved, you then review and accept your contract online.

3. Get paid, same day

Receive the money on the same day you accept your loan offer if you're an existing customer, and elect for the money to be transferred to your Orange Everyday account.

Things to know before you apply:

To be eligible to apply for an ING Personal Loan, you must:

Be aged 18+ and have a valid proof of ID - driver's licence, passport or Medicare

Earn $36,000 or more a year (before tax) with PAYG payslips as your primary source of income

Be an Australian citizen, New Zealand citizen, or a permanent resident of Australia

Maintain an Australian residential address

Have a good credit rating and meet our credit lending guidelines

Note: ING Personal Loans are currently not available to self-employed applicants.

You should have the following supporting documents handy so we can assess your

application faster. Examples of supporting documents can include:

PAYG payslips

Proof of super income

Bank statements

Tax returns

It only takes about 20 minutes to complete our online application form.

Work out how much you might be able to borrow.

Personal loan not quite what you're looking for?

Explore our Orange One low rate credit card with no annual fee

- Low 11.99% p.a. variable interest rate

- Instalment plans with an even lower 9.99% p.a. interest rate

- No ING international transaction fees for eligible customers

- No annual fee